Tips on Deciding Which Tax-filing Status Is Best for You

Your marital status on the last day of the year determines your marital status for the entire year. Who is Required to File.

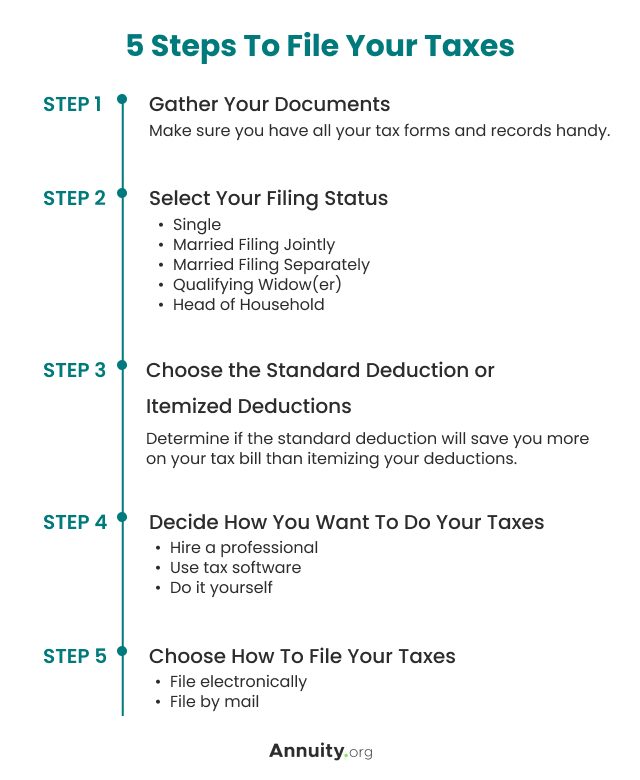

2022 Filing Taxes Guide Everything You Need To Know

Single Filing Status.

. If youre looking to get the largest possible refund it is almost always. Similarly if youre engaged to be married you cannot use the Married Filing Jointly status. Deciding which tax filing status to.

The Rules to Choosing Head of Household When Filing Your Taxes. File at Ease at Home with Turbo Tax You are considered unmarried for the entire year if on the last day of the year you are unmarried or legally separated from your spouse under a decree of divorce or separate maintenance. You must use Single until the year in which you get married.

Reduce The Stress And Minimize Your Tax Obligations With Tax Services From A Paro Expert. Your marital status for the entire tax year is determined by your marital status on. Get Your Max Refund Today.

They will want to determine if they need to file and the best way to do so. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. No Matter What Your Tax Situation Is TurboTax Has You Covered.

You are considered single for the whole year if you were legally single on the last day of the year. Here are eight tips for picking your tax filing status. If you have a tax preparer he or she should do this for you.

If on the last day of the year youre legally separated from your spouse under a final divorce or separate maintenance decree or if you have a court decree of annulment then youre considered unmarried for tax purposes. For example if you get married on December 31 the agency will consider you to. That is because separate filers are not eligible to claim several of the tax deductions and credits available to those who file jointly.

How much tax you will owe. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. It may make sense to you to file separate tax returns but its usually not advisable due to the large number of tax credits you wont qualify for as an.

This is particularly helpful if you qualify for more than one filing status during the tax year. The choice is important since your filing status is used to determine such things as the standard-deduction amount eligibility for certain tax credits and other breaks and ultimately. Under the married filing separately filing status both partners must make the same choice.

Here are eight steps from the IRS that can help you determine your right filing status. Factor this in to your wedding plans. As people prepare to file their taxes there are things to consider.

Filing taxes may not be your favorite chore but its a necessary one to ensure that you stay in the good graces of the IRS. Married couples who file separately typically pay more in taxes than married couples who file jointly. Even if it would benefit you to itemize but your spouse would do best to take the standard deduction you and your partner cannot choose both.

Should You File Jointly or Separately. For starters married couples can file either jointly or separately. On the surface it may seem like the easiest part of your income tax form to fill out aside from your name and address.

Its important that you choose the right one both to ensure the accuracy of your return and to minimize your tax bill. February 11 2020. Taxpayers have a choice between itemizing tax deductions or taking the standard deduction.

Marital Status - The IRS uses your marital status on the last day of the tax year to determine your status for the entire year. If you are still married on December 31 2019 you may file MFJ married filing jointly or MFS married filing separately. The key to choosing the best tax filing status for you is learning about the rules and regulations that apply to each status.

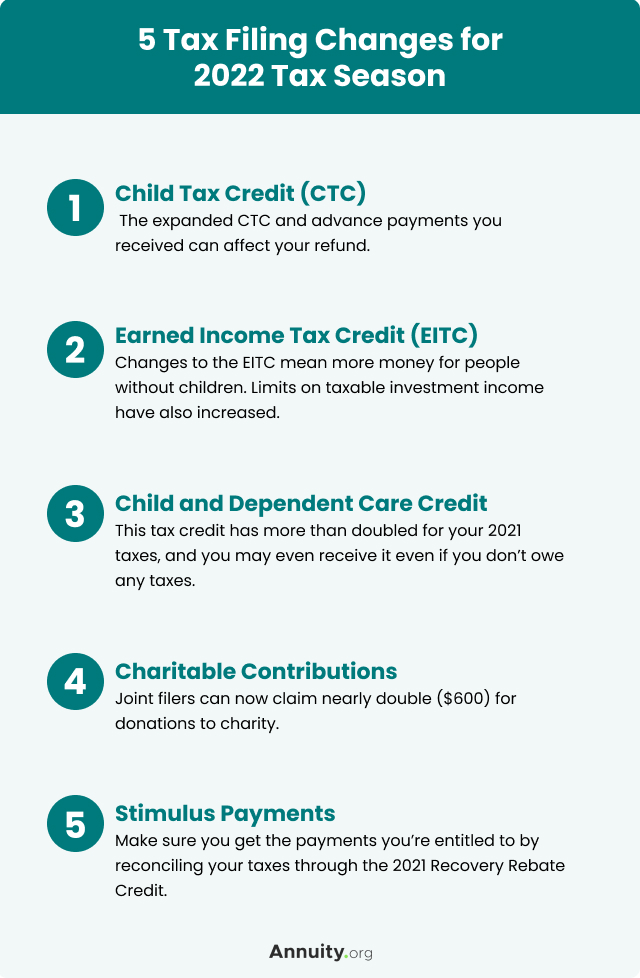

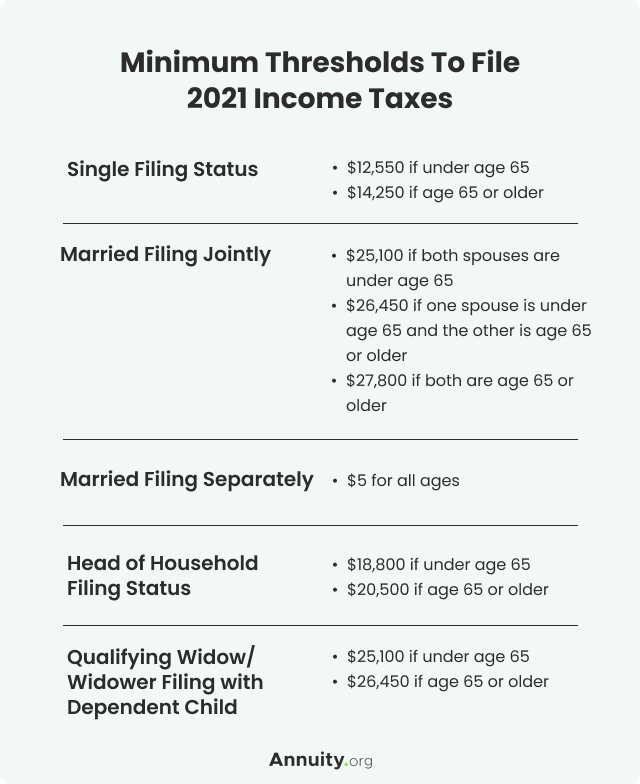

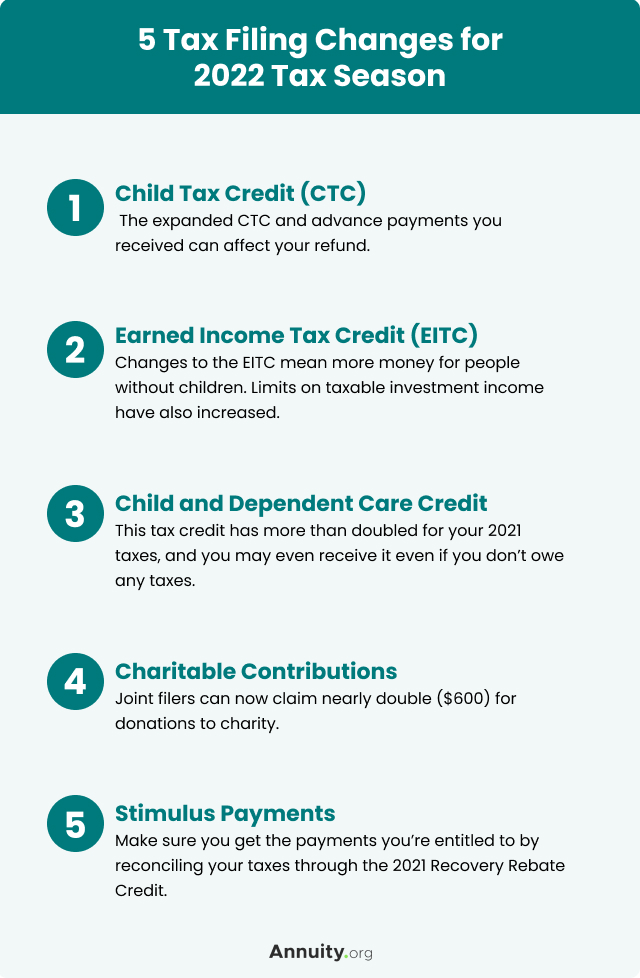

In most cases income filing status and age determine if a taxpayer must file a tax return. Here are three things for people to keep in mind as they prepare to file their taxes. If more than one filing status applies to you choose the.

Credit Karma Tax can help you decide how to choose the qualifying filing status that will best maximize your refund if youre owed one. Single head of household married filing separately married filing jointly and qualifying widow er with dependent child. Each status has an entirely different tax bracket.

There are five filing statuses to choose from when filing your tax return. Choosing a status you dont qualify for If you choose married filing jointly but you and your spouse legally separated or divorced before the end of the year there could be other repercussions. Other rules may apply if the.

Its best to calculate your taxes both ways to determine which way yields the best tax advantage. When You Should File Your Tax Return Separately. If you havent ever been married then its easy to say that youre filing status is unmarried.

A Guide to Choosing The Right Filing Status. At the top of the. Is it better to file separately or jointly.

Youll have to use Married Filing Separately. If your spouse dies during the tax year then you are considered married for the entire year for filing status purposes. How to Decide Which Status is Best for You.

The major question for married taxpayers is. Here are a few tips to help you choose the best tax filing status for your individual situation. Run your taxes both ways when deciding whether to file jointly or separately.

When Married Couples Should File With This Status.

Business Tax Forms Infographic H R Block Business Tax Small Business Tax Business Infographic

Wedding Tip Thursday How Dates And Times Impact Wedding Costs The Pretty Pear Bride Plus Size Bridal Magazine Wedding Costs Wedding Infographic Wedding Tips

11 Smart Ways To Use Your Tax Refund To Maximize Your Money Tax Refund Money Mom Tax Money

Great Infographic Explaining All About Ira Contributions Money Savvy Educational Infographic Smart Money

What Is My Filing Status It Determines Your Tax Liability

Money 101 Cnn Resources Smart Money Financial Goals Money 101

How To Choose The Best Legal Structure For Your Startup Business Infographic Business Advice Business Finance

Pin On Best Of Everything Finance

13 Factors That Affect Car Insurance Rates Car Insurance Car Insurance Rates Insurance

Xrp 10 Oraninda Geriledi Investing Blockchain Bitcoin

2022 Filing Taxes Guide Everything You Need To Know

2022 Filing Taxes Guide Everything You Need To Know

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

View How To File Your Itr For Fy 2019 20 In Just 15 Minutes On Portal Income Tax Return Tax Software Income Tax

Your Irs Tax Return Filing Status Important For Your Taxes

How To Keep More Money In Retirement Diversification That Minimizes Taxation Kiplinger Business Money Money Life Insurance Companies

Comments

Post a Comment